Technical Constraints in Legacy Systems

Infrastructure and Integration Issues

-

Legacy CRM lacked intelligent automation.

-

Disparate borrower data sources (loan systems, payment records, call logs).

-

No centralized reporting for follow-up performance.

Data and Model Limitations

-

No behavioral segmentation or intent prediction models.

-

Limited access to unified historical repayment data.

-

No multilingual NLP capability for borrower conversations.

Scalability and Performance

-

Manual workflows couldn’t scale to handle thousands of overdue accounts daily.

-

Inconsistent follow-up frequency and timing.

How Agentic AI Enables Automated Collection

Solution Overview

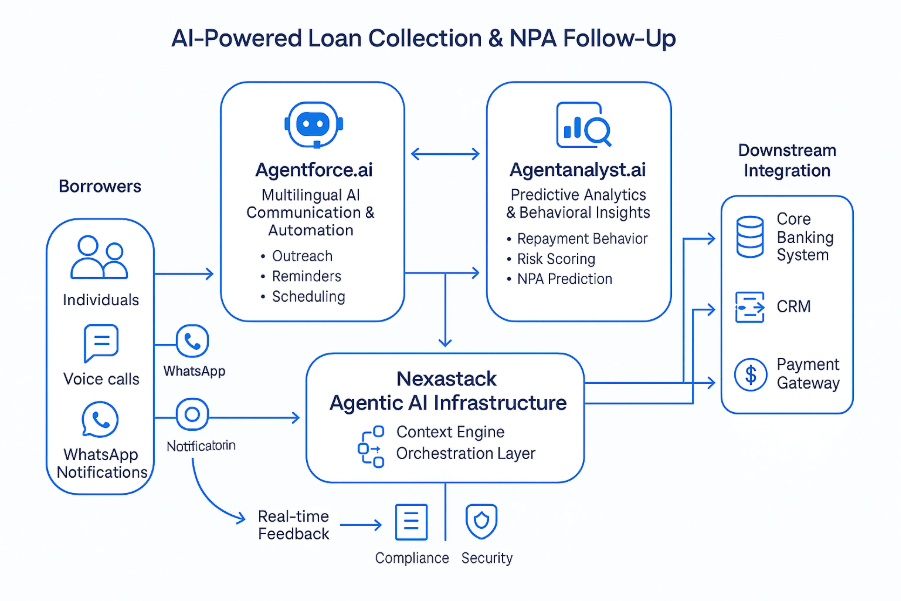

The bank implemented Nexastack’s Agentic AI Collection. Framework using Agentforce and Agentanalyst.

-

Agentforce automated multilingual borrower outreach — via voice calls, WhatsApp, SMS, and email — tailored to borrower language, behavior, and payment history.

-

Agentanalyst applied advanced analytics to assess repayment probability, prioritize accounts, and recommend the best follow-up strategies.

The agents worked together to:

-

Identify high-risk NPAs through behavioral scoring.

-

Auto-trigger personalized follow-ups in the borrower’s preferred language.

-

Schedule EMI reminders, fee explanations, and rescheduling options.

-

Update the CRM automatically with borrower responses and follow-up status.

This context-first, event-driven agentic system improved recovery rates, reduced operational load, and ensured compliance across every borrower interaction.

Targeted Industries

|

Industry |

Use Cases |

Value Delivered |

|

Banking & Financial Services |

Retail loans, credit cards, microfinance |

Higher recovery rate, faster follow-ups, multilingual outreach |

|

NBFCs & Microfinance Institutions |

Rural borrower engagement |

Local-language automation, better borrower experience |

|

Fintech Platforms |

Loan lifecycle automation |

Predictive repayment modeling, lower NPA ratios |

|

Credit Unions & Cooperative Banks |

EMI collection, overdue alerts |

Reduced manual workload, improved compliance tracking |

Recommended Agents

-

Agentforce → Automated multilingual follow-up and borrower communication.

-

Agentanalyst → Behavioral analytics, NPA risk scoring, and predictive insights.

Solution Approach

Predictive Risk Analysis

-

Agent Analyst aggregates loan, payment, and CRM data to predict borrower risk scores.

-

Identifies accounts likely to default and prioritizes them for early outreach.

Intelligent Multilingual Outreach

-

Agent force personalizes borrower engagement using regional language models (English, Hindi, Nepali, Tamil, etc.).

-

Sends timely reminders, explains overdue charges, and offers restructuring options.

-

All communication is tone-checked for compliance and empathy.

Workflow Automation

-

CRM auto-updated with borrower responses, next action dates, and collection outcomes.

-

Seamless integration with loan management and payment systems for real-time updates.

-

Agents operate 24x7, ensuring continuous borrower engagement.

Impact Areas

Model

-

Enhanced NPA prediction accuracy by 40% through behavioral analytics.

-

Continuous feedback loop improved model retraining and targeting precision.

Data

-

Unified borrower data from CRM, payment history, and communication logs.

-

Real-time data pipeline enabled context-aware decision-making.

Workflow

-

Automated end-to-end process: Predict → Engage → Follow-up → Update CRM.

-

Reduced manual workload by 60%.

Results and Benefits

Business Benefits

-

35% faster loan recovery cycles.

-

40% improvement in follow-up conversion rates.

-

50% reduction in manual collection effort.

-

Fully compliant multilingual borrower communication.

Technical Benefits

-

Scalable automation capable of handling 100K+ borrowers.

-

Real-time integration with existing loan and CRM systems.

-

Secure data handling with audit trails for every interaction.

Customer Testimonial

“With Nexastack’s Agentic AI, our loan recovery process became faster, smarter, and more empathetic. Multilingual AI agents connected with borrowers at the right time, with the right message — improving repayment rates and reducing NPA burden significantly.”

— Head of Retail Collections, Leading NBFC

Lessons Learned

-

Human-AI Collaboration Works Best: Combining agentic automation with human oversight led to better borrower trust.

-

Multilingual Context Matters: Borrower empathy increased dramatically when communication was localized.

-

Compliance-First Design: Built-in regulatory filters prevented non-compliant messaging.

-

Data Enrichment is Key: Unified and contextualized borrower data improved

Best Practices

-

Start with small borrower segments and scale gradually.

-

Integrate AI agents tightly with existing CRM and payment systems.

-

Establish feedback loops for continuous model improvement.

-

Ensure transparent, ethical, and compliant communication standards.

Future Plans

-

Expand AI-driven collection to corporate and SME loans.

-

Introduce Agent GRC for compliance governance and audit automation.

-

Develop emotion-aware voice agents for higher borrower empathy.

-

Build multilingual dashboards for collection managers and compliance teams.

Conclusion

By deploying Agentforce and Agentanalyst on Nexastack’s Agentic AI Infrastructure, the bank transformed its loan collection process. Automation, predictive insights, and multilingual engagement reduced NPAs, enhanced compliance, and improved borrower relationships — positioning the institution as a digital-first leader in intelligent loan recovery.